Spring 2022

See what’s NEW for the 2022-23 plan year!

Get more value and variety this upcoming plan year, and enjoy some exciting additions.

Available for all Moda Health medical members starting Oct. 1, 2022

- NEW! Moda removed the Maximum Cost Share (MCS) from medical plans 1-5*. This means all eligible medical expenses (including additional cost tier copay/coinsurances and pharmacy expenses) will now accrue towards the out-of-pocket maximum.

* The MCS is not applicable to plans 6 and 7. - NEW! Continuous Glucose Monitors (CGM) and diabetic testing supplies will only be covered under the pharmacy benefit and no longer covered under the Durable Medical Equipment (DME) benefit.

- NEW! Moda is expanding our Site of Care (SOC) program to add therapeutic oncology medications. Members receiving select infused therapeutic oncology medication from a hospital outpatient setting may be redirected to clinically appropriate home infusion.

- NEW! Moda has a Pre-Diabetes Prevention Program called Pre-D. Members who engage in the Pre-D program can decrease their risk for chronic conditions such as heart disease, stroke and developing Type II Diabetes. The initial session includes an assessment, creation of personal program goals, referral to a Nutritionist and personalized health coaching at no cost to the member. Members who participate in the program will also receive a Fitbit to help them track their weight and exercise.

- NEW! Moda’s new Behavioral Health (BH) program will allow members additional access to providers and expand Black, Indigenous, and people of color providers in the network. The BH Champion included in the program will be able to assist the member in verifying provider availability and help schedule appointments.

- NEW! Out-of-area dependents and members who live outside of the Connexus service area will use Moda’s National Network.

- CirrusMD - text a doctor is available 24 hours, 7 days a week at no member cost sharing.

- NEW! Effective 10/1/22, members on a High Deductible Health Plan will be subject to the deductible and must meet their deductible before the member cost sharing is applied.

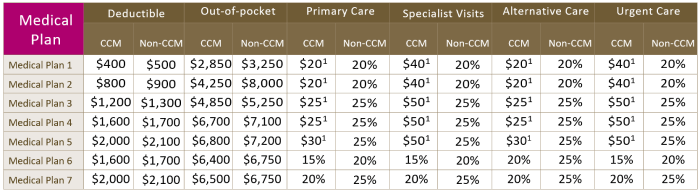

- Medical Plans 1-7 will continue to be offered. See below for plan details. **

- Members have the option to participate in coordinated care and receive the better benefits by selecting a PCP 360 for primary care services.

The better benefits include:

- A lower individual deductible

- A lower individual out-of-pocket maximum

- Lower cost for certain services like primary care office visits, specialist office visits, and alternative care.

- No changes to the deductibles, out-of-pocket limits, copayments or coinsurance

- All Moda medical plans will continue to include our Moda 360 program, which includes access to our Health Navigator team, CirrusMD, Meru Health and much more

Pharmacy

- No changes to pharmacy copays/coinsurance

90-day mail order benefit is through Postal Prescription Services (PPS) or Costco. You can receive additional savings by using the mail-order benefit

Vision

- No changes. Plans Opal, Pearl, and Quartz will continue to be offered

Benefit runs on a plan year basis (not every 12 months)

Benefit maximum includes exam and hardware

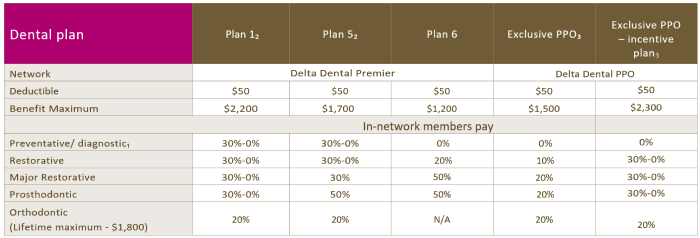

Dental

- NEW! OEBB added our Preventive First program. This means all preventive services will no longer accrue towards the benefit maximum and members will have additional dollars to use for basic and major services (i.e., fillings, crowns, and implants).

No changes to dental annual benefit maximum, copays and coinsurance. Dental plans 1, 5, 6, Exclusive PPO, and Exclusive PPO – incentive plan will continue to be offered**.

Premier Plans 1, 5, and 6 utilize the Delta Dental Premier Network. The Exclusive PPO and Exclusive PPO – Incentive plan will use the Delta Dental PPO Network.

The Exclusive PPO plan, and the Exclusive PPO Incentive plan, require that members use a Delta Dental PPO provider. These plans do not pay for services provided by a Premier Network or non-contracted provider.

** Please check with your entity on their plan selection as some entities do not offer all Moda Health medical plans or Delta Dental Plans.

Delta Dental plan options

1 Deductible waived.

2 Under this incentive plan, benefits start at 70 percent for your first plan year of coverage. Thereafter, benefit payments increase by 10 percent each plan year (up to a maximum benefit of 100 percent) provided the individual has visited the dentist at least once during the previous plan year. Failure to do so will cause a 10 percent reduction in benefit payment the following plan year, although payment will never fall below 70 percent

3 This plan has no out-of-network benefit. Services performed outside the Delta Dental PPO network are not covered unless for a dental emergency.

Medical plans 1-7 (Connexus Network)

1 Deductible waived. All amounts reflect member responsibility. Subscriber-only amounts shown. Family deductible and out-of-pocket maximums vary by plan. See plan options brochure for details.

Previous story

Make a healthy change. A health coach is waiting for you.

Copyright © 2026 Moda Partners, Inc. All rights reserved.